Today's update is presented primarily in charts. Tomorrow's weekly update will provide a more detailed analysis. Watch tomorrow for new pages on the site. We'll unveil our InTrade trading portfolio (using InTrade play bucks). If you're interested in trying you own hand at "playing" the InTrade markets, visit the InTrade homepage at http://www.intrade.com/ and click on practice on the left hand side of the page.

Markets were basically sideways today. No major moves in either direction. Republicans maintain a firm grasp on the House side and are waiting for a move upward from either Dino Rossi or Carly Fiorina to get them to 51.

House Charts

Senate Graphics

Saturday, October 23, 2010

Friday, October 22, 2010

Republicans Top 89% in Battle for House; Washington and California in the Senate

Republicans topped 89% in their quest to control the U.S. House of Representatives in today's simulation. In the Senate, our macro model saw a very slight increase of just over 1% in the probability for a Republican controlled Senate. Our micro model moved a corresponding amount in the opposite direction.

The action remains focused in the seven states we've previously discussed. At this point it appears that Republicans will need to move California or Washington in their direction, but time is running out. If Republicans win in all the states we currently rate their win probability above 50%, they will emerge with 50 seats leaving them one short.

Other charts are posted below including Senate control, our micro model's Senate seat projection, and our projected House seats chart.

We've also added the opportunity to post comments on our posts or the races in general. Please note that these comments will be moderated.

Thursday, October 21, 2010

GOP House Control Probability Hits New High; InTrade Adds Contracts Above Gains of 60

The probability of House control rose to new highs today topping 88% on our midpoint pricing estimate. Our estimates are based on an analysis of InTrade pricing data.

Our model's estimate of Republican House seats retreated slightly with our midpoint estimate coming in at 234. This equates with a 57 seat gain from Republicans' post-2008 election position. Also of interest today was InTrade's addition of contracts for Republican gains of 65+, 70+, 75+, and 80+ seats.

After a day of high volatility yesterday in our seven "Most Competitive Senate Races," today proved more sedate with our model showing a change of more than 5% on our midpoint pricing estimate in only one of the seven races. In Pennsylvania, Republican candidate Pat Toomey regained some of the ground he had given up to Rep. Joe Sestak. Toomey's probability of victory advanced by 6.5% to 71.7%.

Republicans are now above a 50% probability of victory in 27 of 37 Senate races. If they win all of those seats, they would emerge from the election with 50 seats meaning that they would need to triumph in either Washington or California to win control.

The table to the left shows the present standing on all three of our pricing estimates, while the next graph illustrates some of the recent volatility in the seven races. As noted, the major change of the day was in Pennsylvania. Pennyslvania may see continued moves of this magnitude on a daily basis as market traders evaluate daily tracking data that is now being released for that race.

Tomorrow could prove to bring about more volatility as we may see a new round of polling data on several of these races.

The probability of a Republican takeover of the Senate improved very slightly using both versions of our model. Both models still suggest less that a 20% probability of a Republican takeover.

Both versions of our model produced a seat estimate of between 48 and 49 seats today. The last chart included today is the trend of Republican seat estimates under the micro version of our model.

Our model's estimate of Republican House seats retreated slightly with our midpoint estimate coming in at 234. This equates with a 57 seat gain from Republicans' post-2008 election position. Also of interest today was InTrade's addition of contracts for Republican gains of 65+, 70+, 75+, and 80+ seats.

After a day of high volatility yesterday in our seven "Most Competitive Senate Races," today proved more sedate with our model showing a change of more than 5% on our midpoint pricing estimate in only one of the seven races. In Pennsylvania, Republican candidate Pat Toomey regained some of the ground he had given up to Rep. Joe Sestak. Toomey's probability of victory advanced by 6.5% to 71.7%.

Republicans are now above a 50% probability of victory in 27 of 37 Senate races. If they win all of those seats, they would emerge from the election with 50 seats meaning that they would need to triumph in either Washington or California to win control.

The table to the left shows the present standing on all three of our pricing estimates, while the next graph illustrates some of the recent volatility in the seven races. As noted, the major change of the day was in Pennsylvania. Pennyslvania may see continued moves of this magnitude on a daily basis as market traders evaluate daily tracking data that is now being released for that race.

Tomorrow could prove to bring about more volatility as we may see a new round of polling data on several of these races.

The probability of a Republican takeover of the Senate improved very slightly using both versions of our model. Both models still suggest less that a 20% probability of a Republican takeover.

Both versions of our model produced a seat estimate of between 48 and 49 seats today. The last chart included today is the trend of Republican seat estimates under the micro version of our model.

Wednesday, October 20, 2010

Senate Volatility Promised, Senate Volatility Delivered

And the Six Became Seven

Over the past several days we have suggested that control of the United States Senate would come down to the results in six states. Well ... today the six became seven as Republican prospects in Pennsylvania took a nose dive in the judgement of InTrade market participants. As a result we've added the Keystone State to both our "Tracking Key Senate Races" graph and "Competitive Senate Races" table. Today also saw a major rebound in Republican prospects in West Virginia as well gains in excess of 5% in Washington and California. Action was basically sideways in our model's evaluation of the data in Illinois, Colorado and Nevada.

At the suggestion of one of our readers, we've added directional arrows to the table at the left to provide a better illustration of movement over the past 24 hours.

In terms of Democrats prospects to hold the Senate, the emergence of Pennsylvania on our "Most Competitive" screen means that Democrats need only win 2 of 7 races in this category to hold operational control of the Senate. But ... if you are an InTrade market investor, remember that independents do not count in determining control under the "Democrats to Control Senate" contract. Senators Lieberman and Sanders do not count toward Democrats reaching to 50 they need for this contract to expire at 100. In other words, if Republicans end up holding 49 or more seats, this contract will expire at zero. InTrade has clarified that even though Senator Murkowski is running as a write-in candidate that is "officially running as a Republican. Should Murkowski win the seat it will be considered a Republican seat."

Despite the emergence of Pennsylvania, on balance Republican prospects improved on Wednesday. Our individual and cumulative outcome distribution graphs follow.

Our midpoint estimates in the micro and macro versions of our model both showed modest improvement for Republicans based on an evaluation of Wednesday's InTrade data. Our micro estimate rose to 47.8 seats while our macro model estimate increased to 49 seats.

Republican control probabilities under both models both came in well under 20%.

Republican prospects for House control remain solid coming in at a midpoint estimate of 86%. Our projected seat estimate today is 235 at all three pricing points.

This is essentially unchanged over the last three days of our model's evaluation of InTrade contract data.

What to Expect

Continued volatility based not just on polling data, but on other news -- particularly economic data. Democrats should count their "lucky stars" that the next national Employment Situation report is not due out until the Friday after the election. Based on Gallup's polling, it is likely that the report from BLS will show an increase in the unemployment rate from the 9.6% reported earlier this month.

However, there are a few government reports on economic conditions coming out pre-election that could impact voters actions.

First, this Friday, BLS will release its State and Regional Employment and Unemployment report. News of state unemployment rates and payroll jobs data for individual states could have an impact in those states.

Second, the Labor Department will report unemployment insurance claims data on both this Thursday and next Thursday.

Third, with the focus on issues swirling within the real estate market, there will be interest in the release of both Case-Shiller and FHFA home price data on Tuesday, October 25th.

Fourth, two reports from the Bureau of Economic Analysis will be released before the election. On Friday, October 29 BEA will release its advance estimate of 3rd quarter Gross Domestic Product. Monday, Novemeber 1st, they will provide estimates of personal income and outlays for September.

Stay tuned and expect continued volatility.

Over the past several days we have suggested that control of the United States Senate would come down to the results in six states. Well ... today the six became seven as Republican prospects in Pennsylvania took a nose dive in the judgement of InTrade market participants. As a result we've added the Keystone State to both our "Tracking Key Senate Races" graph and "Competitive Senate Races" table. Today also saw a major rebound in Republican prospects in West Virginia as well gains in excess of 5% in Washington and California. Action was basically sideways in our model's evaluation of the data in Illinois, Colorado and Nevada.

At the suggestion of one of our readers, we've added directional arrows to the table at the left to provide a better illustration of movement over the past 24 hours.

In terms of Democrats prospects to hold the Senate, the emergence of Pennsylvania on our "Most Competitive" screen means that Democrats need only win 2 of 7 races in this category to hold operational control of the Senate. But ... if you are an InTrade market investor, remember that independents do not count in determining control under the "Democrats to Control Senate" contract. Senators Lieberman and Sanders do not count toward Democrats reaching to 50 they need for this contract to expire at 100. In other words, if Republicans end up holding 49 or more seats, this contract will expire at zero. InTrade has clarified that even though Senator Murkowski is running as a write-in candidate that is "officially running as a Republican. Should Murkowski win the seat it will be considered a Republican seat."

Despite the emergence of Pennsylvania, on balance Republican prospects improved on Wednesday. Our individual and cumulative outcome distribution graphs follow.

Republican control probabilities under both models both came in well under 20%.

Republican prospects for House control remain solid coming in at a midpoint estimate of 86%. Our projected seat estimate today is 235 at all three pricing points.

This is essentially unchanged over the last three days of our model's evaluation of InTrade contract data.

What to Expect

Continued volatility based not just on polling data, but on other news -- particularly economic data. Democrats should count their "lucky stars" that the next national Employment Situation report is not due out until the Friday after the election. Based on Gallup's polling, it is likely that the report from BLS will show an increase in the unemployment rate from the 9.6% reported earlier this month.

However, there are a few government reports on economic conditions coming out pre-election that could impact voters actions.

First, this Friday, BLS will release its State and Regional Employment and Unemployment report. News of state unemployment rates and payroll jobs data for individual states could have an impact in those states.

Second, the Labor Department will report unemployment insurance claims data on both this Thursday and next Thursday.

Third, with the focus on issues swirling within the real estate market, there will be interest in the release of both Case-Shiller and FHFA home price data on Tuesday, October 25th.

Fourth, two reports from the Bureau of Economic Analysis will be released before the election. On Friday, October 29 BEA will release its advance estimate of 3rd quarter Gross Domestic Product. Monday, Novemeber 1st, they will provide estimates of personal income and outlays for September.

Stay tuned and expect continued volatility.

Democrats Continue Clawback in Senate; A Word on Likely Voter Models

Democrats continued to improve their standing in the battle to control the Senate. Results were mixed in our six key Senate races with Republicans improving marginally in some and Democrats in others. Expect volatility in both directions as additional polling is released over the next couple of days.

However, if you are an investor in InTrade or other prediction markets, we will offer a word of caution for evaluating various new polling information after giving the run down of today's data. We'll also have more to say on this over the next couple of days.

Markets have downgraded Republican prospects in recent days in Colorado and Washington. These changes in particular have influenced our micro model's projections for Republican gains in the Senate. As the Daily Snapshot (below the break) shows our micro model is projecting a median estimate of 47.6 seats. Our macro model is projection a median estimate of 48.7 seats.

However, if you are an investor in InTrade or other prediction markets, we will offer a word of caution for evaluating various new polling information after giving the run down of today's data. We'll also have more to say on this over the next couple of days.

Markets have downgraded Republican prospects in recent days in Colorado and Washington. These changes in particular have influenced our micro model's projections for Republican gains in the Senate. As the Daily Snapshot (below the break) shows our micro model is projecting a median estimate of 47.6 seats. Our macro model is projection a median estimate of 48.7 seats.

Monday, October 18, 2010

House GOP: Knocking on 60's Door

Republicans are knocking on the door of gaining 60 seats in the House on November 2, 2010. Our current model's upper limit estimate clocked in at 236 seats or a gain of 59 seats from the 177 they held after the 2008 election. In the Senate, our macro level model is projecting a median estimate of 48.9, while the micro model registered a median estimate of 47.9.

As the table to the left illustrates, our model continues to rate the probability of a Republican House takeover at 86.5%; the macro and micro models give Republicans a 4.6% and 16.4%, respectively, of gaining Senate control. Our model estimate are based upon a statistical analysis of data from the InTrade prediction markets.

As the table to the left illustrates, our model continues to rate the probability of a Republican House takeover at 86.5%; the macro and micro models give Republicans a 4.6% and 16.4%, respectively, of gaining Senate control. Our model estimate are based upon a statistical analysis of data from the InTrade prediction markets.

Sunday, October 17, 2010

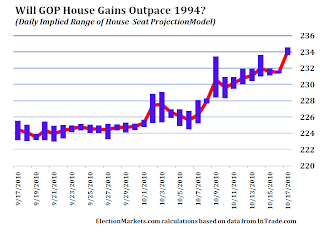

Weekly Update: Will Republican House Gains Surpass 1994?

Will Republican gains in the House of Representatives surpass their gains in 1994? Based on our analysis of InTrade data that outcome is becoming more likely than not.

Today's midpoint estimate -- 234 seats or an increase of 57 seats from the 177 Republicans held after the 2008 elections. Additionally, our model gives Republicans an 86.5% chance of taking control of the House of Representatives. Republican prospects have experienced a generally uninterupted march higher over the past two weeks. The question is whether or not this momentum will continue for another 15 days.

As the chart to the left shows, it isn't simply the projected gains that have steadily advanced, but the probability of House control as well.

The situation isn't quite as sanquine for Republicans on the Senate side of the ledger. Democratic prospects have been improving over the past week. As the Daily Snapshot illustrates, our micro model projects 47.8 Republican seats and the macro model projects 48.8 seats.

Prospects for Republican control are rated below 20% on both of our models. It is important to remember that the micro version of our model is a straight statistical simulation that assumes that each of the races operates as an independent event. In a trend election that will be less true than in a run of the mill election year.

The difference in the estimates of our macro model and micro model are based in part on the perception of what the trend effect will be AND the market's view of what seats are actually in play. As the next chart shows, the trend on our micro model's estimate has turned more favorable to Democrats over the past week.

While Republican prospects for Senate control is not "great" at this point in time, our models' projections of 48 or 49 seats -- representing gains of 7 or 8 seats is not insignificant.

As we have noted in previous posts, the battle for the Senate seems focused on six seats -- California, Colorado, Illinois, Nevada, Washington, and Wisconsin.

If Repbulicans were to capture all of the seats in which they are above 50% in our midpoint estimates, they would end up with 49 seats in the Senate, slightly above both of our statistical model estimates. However, readers should be on the lookout for significant volatility over the course of the next week. Recent polling has given widely varying pictures of the individual races, particularly in Washington and West Virginia. The other race on our "list of six" that may provide some entertainment is in California where recent polling has suggested a race where Senator Barbara Boxer is only narrowly ahead of former HP CEO Carly Fiorina. The next chart shows just how volatile the InTrade markets have been in the six races since the beginning of September.

Note the volatility over the past month in the Washington and West Virginia races. The data would suggest future volatility is more likley than not as we approach election day.

For those who are into charts, additional charts follow that show the probability distribution from our micro model's Senate projections on both a cumulative and an individual basis. Both charts show results for today compared with September 1 -- before Senator Murkowski's announcement that she would run as a write-in candidate and before Christine O'Donnell's victory in the Delaware Republican primary. Readers will note that Republican prospects are significantly better than on September 1. Also included below is our chart showing trends in the InTrade contracts for Senate control.

Today's midpoint estimate -- 234 seats or an increase of 57 seats from the 177 Republicans held after the 2008 elections. Additionally, our model gives Republicans an 86.5% chance of taking control of the House of Representatives. Republican prospects have experienced a generally uninterupted march higher over the past two weeks. The question is whether or not this momentum will continue for another 15 days.

As the chart to the left shows, it isn't simply the projected gains that have steadily advanced, but the probability of House control as well.

The situation isn't quite as sanquine for Republicans on the Senate side of the ledger. Democratic prospects have been improving over the past week. As the Daily Snapshot illustrates, our micro model projects 47.8 Republican seats and the macro model projects 48.8 seats.

Prospects for Republican control are rated below 20% on both of our models. It is important to remember that the micro version of our model is a straight statistical simulation that assumes that each of the races operates as an independent event. In a trend election that will be less true than in a run of the mill election year.

The difference in the estimates of our macro model and micro model are based in part on the perception of what the trend effect will be AND the market's view of what seats are actually in play. As the next chart shows, the trend on our micro model's estimate has turned more favorable to Democrats over the past week.

While Republican prospects for Senate control is not "great" at this point in time, our models' projections of 48 or 49 seats -- representing gains of 7 or 8 seats is not insignificant.

As we have noted in previous posts, the battle for the Senate seems focused on six seats -- California, Colorado, Illinois, Nevada, Washington, and Wisconsin.

If Repbulicans were to capture all of the seats in which they are above 50% in our midpoint estimates, they would end up with 49 seats in the Senate, slightly above both of our statistical model estimates. However, readers should be on the lookout for significant volatility over the course of the next week. Recent polling has given widely varying pictures of the individual races, particularly in Washington and West Virginia. The other race on our "list of six" that may provide some entertainment is in California where recent polling has suggested a race where Senator Barbara Boxer is only narrowly ahead of former HP CEO Carly Fiorina. The next chart shows just how volatile the InTrade markets have been in the six races since the beginning of September.

Note the volatility over the past month in the Washington and West Virginia races. The data would suggest future volatility is more likley than not as we approach election day.

For those who are into charts, additional charts follow that show the probability distribution from our micro model's Senate projections on both a cumulative and an individual basis. Both charts show results for today compared with September 1 -- before Senator Murkowski's announcement that she would run as a write-in candidate and before Christine O'Donnell's victory in the Delaware Republican primary. Readers will note that Republican prospects are significantly better than on September 1. Also included below is our chart showing trends in the InTrade contracts for Senate control.

Subscribe to:

Comments (Atom)